Translate Website

Company

Marketing Completion Fund, Inc. is a media investment company founded in 2017 to finance, develop, and distribute original and existing intellectual property (“IP”).

- Our vision is to apply a Financing Risk Mitigation and Marketing Technology System to reduce risks investing in new intellectual property (“IP”) ventures and monetizes revenue globally.

- MCF will invest in IP developed by early stage companies in a range of industry sectors and provides professional consulting services to companies focused on IP technology. (e.g. Artificial Intelligence, Augmented Reality, Brands, Films, Games, MarTech, MedTech, and Virtual Reality)

- Service pricing options are typically a combination of hourly rate, monthly retainer, commissions for product sales, and equity shares of company stock based on contribution to the anticipated company's growth in value.

- Current Clients: Alternative Quant Fund, (AI) Artificial Intelligence, MedTech, BPO Call Center, China – U.S. Cross Border Entertainment, FinTech, Real Estate, SaaS Technology

Financing Risk Mitigation System

- The Financing Risk Mitigation System addresses a perennial question for investors that would like to reduce risk in any new venture: namely, protection of invested capital and infusion into the venture upon proven milestone achievement. If these milestones are not met in a timely manner, then the remaining investor capital will be returned.

- For film financing the marketing technology system and marketing strategy is designed to optimize generating revenue streams PRIOR to principal film photography and after theatrical and digital distribution of the film.

Services

MCF provides professional services that include IP brand and technology development, capital formation structuring, financial modeling and capital raising, content development and production, marketing, sales, and distribution.

Featured Projects

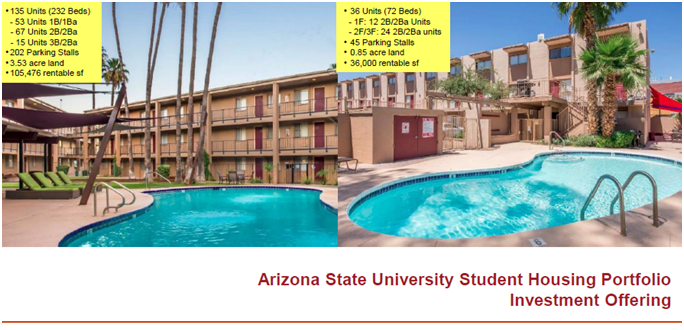

A Student Housing Investment Management Platform

|

Document PDF (Click to Download)

|

An opportunity to invest with a privately-held investment operating company widely regarded as a leading student housing operator and investor focusing on the student housing sector.

The primary real estate focus is on acquiring core/core-plus, value-add and development student housing projects at Universities/Colleges with significant international student populations in the Western U.S. The three founding members of the firm have closed over $17 billion transactions over their real estate As of January 2018 the company has closed 5 properties with an estimated completed value of approximately $200 million. Existing investors Include industry leading institutional foreign and domestic investors Total assets under ownership and management estimated at approximately $390 million. The company is based in Downtown Los Angeles, California, is employee-owned, with one external investor from one of the largest family office in Asia | ||

Alternative Quant Smart Beta Investing

|

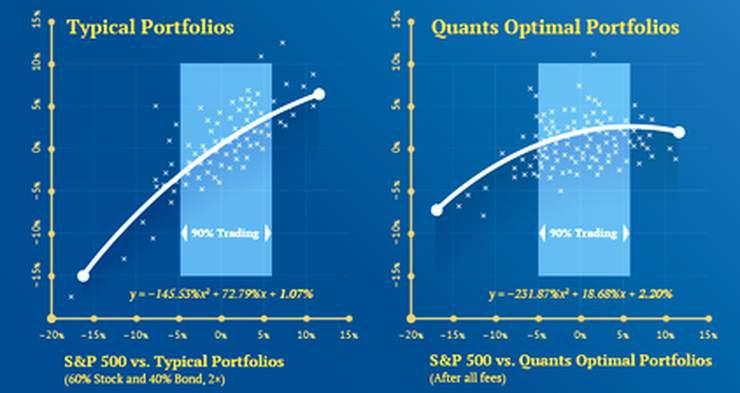

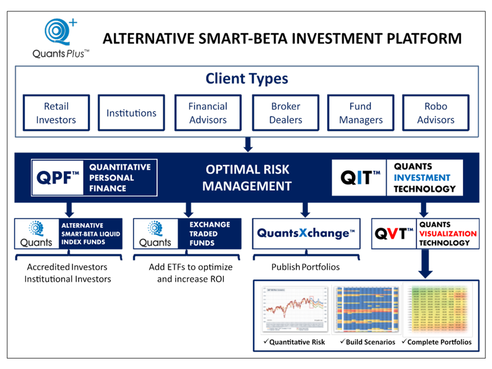

Quants Inc (“Quants”) is a financial technology and asset

management company in Los Angeles, California since 2010. Quants has built proprietary quantitative risk indices for smart beta investing with derivative overlays that can improve the portfolios to potentially deliver two times better distribution of monthly returns without tactical trading. Document PDF (Click to Download)

| |||

FinTech Alternative Investment SAAS Platform

Document PDF (Click to Download)

| |||

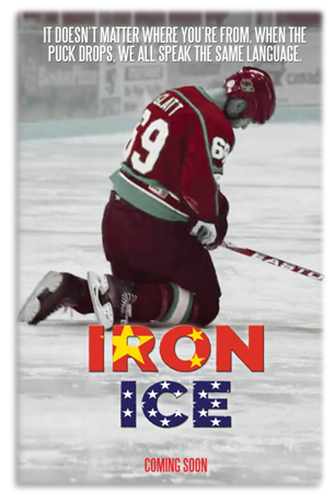

China - U.S Cross Border Sports, Entertainment and Technology Project

|

MCF is developing and financing the Iron Ice film and Hat Trick lifestyle brand intellectual properties (IP) targeting the China, U.S. and global entertainment ($2.2 trillion) and sports ($1.5 trillion) markets.

Document PDF (Click to Download)

|

IRON ICE FILM SIZZLE REELhattrick is the video password

Chinese language - https://vimeo.com/228180264

English language - https://vimeo.com/228179702

| ||

Projects 2015 – 2017

|

|

Company Experience

The management team, advisors, consultants, and partners are comprised of individuals and companies that have extensive experience in Capital Formation Structuring, Financial Modeling, and Capital Raising, China M&A, Digital Marketing, Entertainment, Film Financing, Production and Distribution, IP Brand and Technology Development, Marketing Technology, Product Development, Semiconductor Plant Manufacturing, Software Development, Sports, AR/VR Technology Labs, and Wealth Management.

- Technology – Developed AR/VR technology for United States government agencies and built semiconductor plants in United States and Taiwan.

- Capital – Developed innovative capital formation structures and capital raising strategies. Provided services to 234 securities engagements totaling $2,173,809,195 in capital raised.

- Films – Experience in the acquisition and selling of $5 billon of film content for major studios, successfully produced and distributed independent feature films, and documentaries.

- Games – Developed sports games for Activision, EA, Midway, and Sony that generated $1.5 billion in sales. Developing next generation AR/VR games and eSports experiences.

- Lead Generation – Digital marketing and call center services for financial service companies and consumer brands.