Revolutionary Technology for Optimal Risk Management

QuantsPlus has solved a problem facing many investors seeking better portfolio risk management.

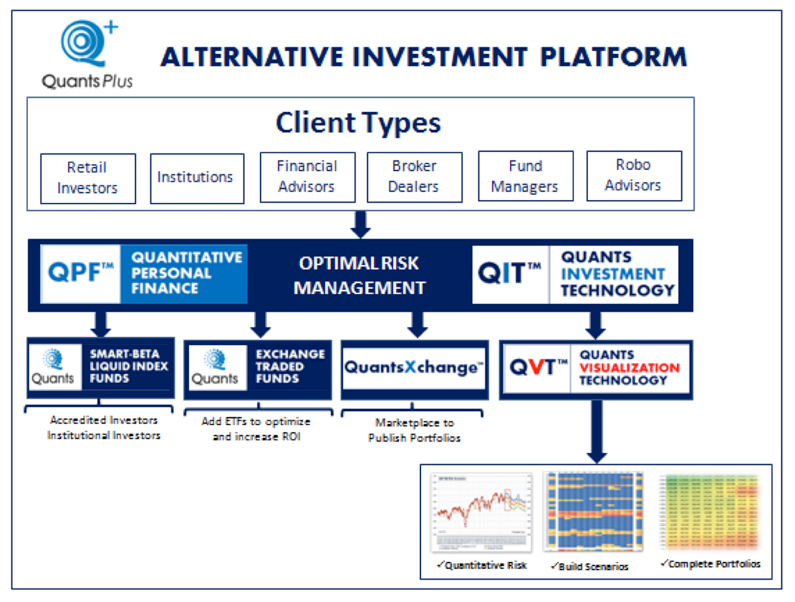

The company is solving the problem by building the first turnkey alternative investment platform with proprietary risk management software that potentially generates better risk-adjusted returns. The online experience will be used by advisors, institutions and individual investors seeking to reduce risk and optimize ROI.

Problem Definition:

Many experts agree that the shift from human to science-based, model-driven advice is long overdue given that currently the investor landscape is severely exposed to costly human error and sub-optimal decisions risking portfolios to underperform and failing to beat the overall market. While institutional clients have access to sophisticated yet expensive risk management products and technology, retail clients are bound with limited set of options offered by their financial advisors. Investors lack visibility into their risk positions, leading to poor control and sub-optimal decisions.

Solution:

The QuantsPlusÔ investment platform will democratize sophisticated risk management for investors from Millennials to Baby Boomers and promote the financial literary in investing. All investors will have access to advanced risk management and financial decision making without having to worry about the financial engineering. Investors will have a simple and exciting user interface into robust risk management.

QuantsPlus has solved a problem facing many investors seeking better portfolio risk management.

The company is solving the problem by building the first turnkey alternative investment platform with proprietary risk management software that potentially generates better risk-adjusted returns. The online experience will be used by advisors, institutions and individual investors seeking to reduce risk and optimize ROI.

Problem Definition:

Many experts agree that the shift from human to science-based, model-driven advice is long overdue given that currently the investor landscape is severely exposed to costly human error and sub-optimal decisions risking portfolios to underperform and failing to beat the overall market. While institutional clients have access to sophisticated yet expensive risk management products and technology, retail clients are bound with limited set of options offered by their financial advisors. Investors lack visibility into their risk positions, leading to poor control and sub-optimal decisions.

Solution:

The QuantsPlusÔ investment platform will democratize sophisticated risk management for investors from Millennials to Baby Boomers and promote the financial literary in investing. All investors will have access to advanced risk management and financial decision making without having to worry about the financial engineering. Investors will have a simple and exciting user interface into robust risk management.

- There are many investment platforms in the digital wealth management industry but QuantsPlus™ is the first patent-pending SaaS investment platform to streamline and democratize smart-beta alternative portfolio construction and investing that simplifies risk management and return optimization with derivatives.

- QuantsPlusÔ is going to pioneer the idea of quantitative personalized finance with the QPFÔ experience that will be the future of online investing personalized according to the needs and risk tolerance of active investors, traders and institutions.

|

QuantsPlus™ is a patent-pending Software-as-a-Service alternative investment platform offering the following:

|

Easy to Use

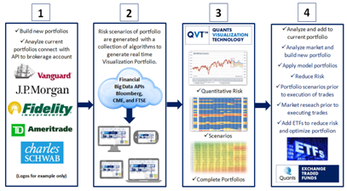

Step 1

Step 1

- Build new portfolios

- Anaylze current portfolios connect with API to brokerage account

- Risk scenarios of portfolio are generated with a collection of algorithms to generate real time Visualization Portfolio.

- Financial Big Data APIs Bloomberg, CME, and FTSE

- QVT™- Quants Visualization Technology

- Risk scenarios of portfolio are generated with a collection of algorithms to generate real time visualization portfolio.

- Analyze and add to current portfolio

- Analyze market and build new portfolio

- Apply model portfolios

- Reduce Risk

- Portfolio scenarios prior to execution of trades

- Market reseach prior to executing trades

- Add ETFs to reduce risk and optimize portfolios